Buyers hunt for ‘survivors’ in US earnings year

[ad_1]

Buyers scouring companies’ benefits in the US earnings period that commenced this 7 days are not looking for expansion. Instead, although the coronavirus pandemic tears a gap out of economies close to the planet, several are searching for firms that can endure.

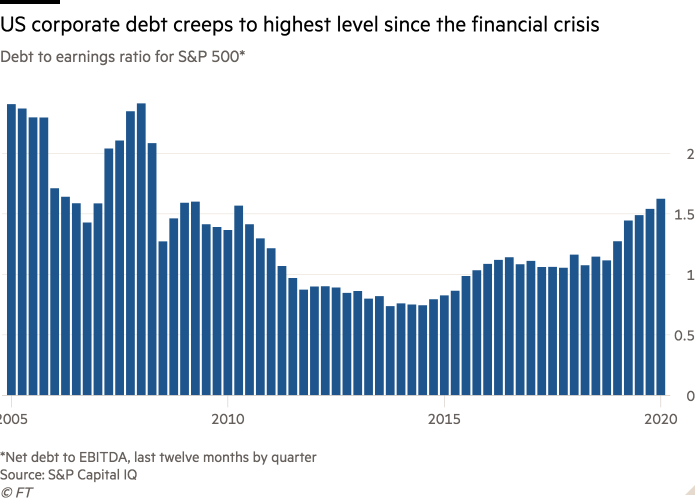

Stung by unexpected stops to revenues, many providers have fallen back again on credit traces and credit card debt borrowed in bond marketplaces to retain by themselves afloat. US investment-grade corporations lifted a history $150bn in March, as firms hoarded income to climate the downturn. Equity fund administrators want to make confident companies can repay those debts and cling on until eventually lockdowns stop and existence gets back again to normal.

“Survivability will be more appropriate than near-time period profitability — the standard metrics won’t make a difference that considerably,” claimed Liz Ann Sonders, chief investment decision strategist for Charles Schwab, about initially-quarter earnings. “For organizations that are in the crosshairs of this, there aren’t heading to be any close to-time period gains — that ship has sailed.”

US financial institutions, historically between the initial to report, have begun to paint a grim photograph of America’s corporate health. JPMorgan Chase’s earnings miss on Tuesday was the greatest due to the fact at least 2009, as considerably as Bloomberg documents stretch. The country’s greatest lender by assets, which created hefty provisions for bank loan losses, established a craze adopted by Wells Fargo, Financial institution of The united states and Morgan Stanley.

The KBW Banking companies index fell 14 for each cent from the get started of the week to Thursday’s close, on keep track of for the 3rd-worst week considering that the financial disaster.

The early final results set an ominous tone for the initially reporting year since the US financial state entered lockdown. If industrial and buyer sectors observe a comparable route, that could be plenty of to threaten the large rally in stocks due to the fact the depths of the provide-off in March.

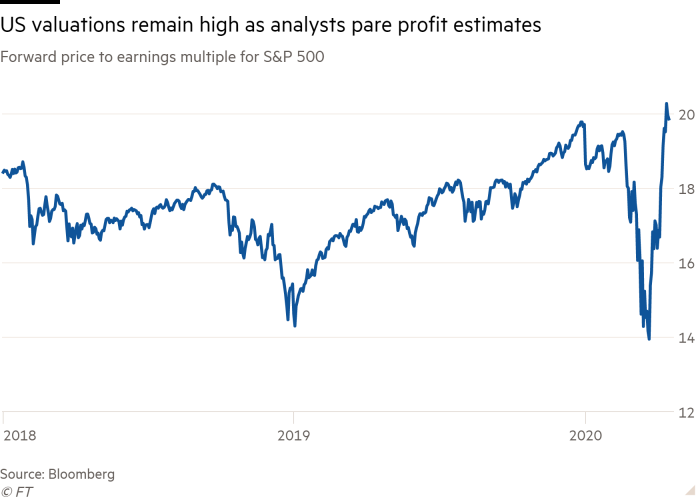

The forward value-to-earnings ratio for organizations in the S&P 500, a well-known way for buyers to assess irrespective of whether inventory markets are running in advance of estimates of corporate income, is presently back again to levels found in January, in advance of the virus commenced to unsettle traders.

Some fund administrators are even now seeking to come across prospects. Healthcare corporations, which are immediately involved in the reaction to the virus, may emerge as a person of the most powerful havens, mentioned Margaret Vitrano, a portfolio manager with ClearBridge Investments.

“We are paying a ton of time looking at healthcare,” she stated. “One of the results of the virus is that hospitals and healthcare services are very entire, but people are deferring other techniques. Above time, they will occur back.”

Any destructive response to to start with-quarter success could also supply the probability to get into shares that have extensive had a pricetag some buyers are unwilling to pay.

Susan Schmidt, head of US equity for Aviva Traders Americas, has requested her crew of portfolio administrators and analysts to compile a “wish list” of stocks that fell challenging throughout the bear market place. Quite a few have given that loved gains, but there are nonetheless attractive organizations investing at a reasonable cost, she said.

“The chance in this market is to determine out exactly where the mispricing has took place,” Ms Schmidt claimed. “If you see as a result of the disaster there will be prospects.”

But actual bargains are the exception fairly than the rule, claimed Lee Spelman, head of US equities for JPMorgan Asset Administration. “I’ve lived by a great deal of crises — the 1987 crash, the tech boom and bust, the money crisis — but we have never seen everything like this,” she explained. “The economic system has just stopped and you have a black gap with revenues and funds stream. If you simply cannot make it out the other side [profits] won’t seriously make a difference.”

Analysts stated they are centered on measuring how substantially credit history organizations can entry and the likelihood that companies will breach limits on borrowing agreed with traders. Portfolio administrators are also eager to see which organizations will profit from the $2tn spending package the US government unveiled previous thirty day period.

Numerous of these inquiries will not be answered by the earnings figures, but will be dealt with in phone calls with executives, and in the assistance for potential quarters that quite a few providers withheld previously this calendar year. “The quarterly earnings are not heading to be terrific but the ahead assistance is what will be most essential,” claimed Ms Vitrano.

Analysts be expecting earnings-per-share for providers in the S&P 500 to fall 15 for each cent for the quarter in comparison with the very same period past 12 months and 10 for each cent for the full year, according to Refinitiv.

Power corporations are probable to endure most, pressured by the slipping oil cost, in accordance to Credit score Suisse projections, followed by consumer discretionary companies these as shops and carmakers. Utilities and communications services, a broad grouping that involves media corporations, will maximize earnings, in accordance to the lender, when healthcare is most likely to be flat.

“For vitality and buyer cyclicals, such as airlines and vacation businesses, it will be extremely, very challenging,” Ms Spelman reported.

Editor’s take note

The Money Instances is making crucial coronavirus protection totally free to go through to assistance everyone remain educated. Find the newest in this article.