Oil tops $70 a barrel as Middle East tensions rattle marketplaces

[ad_1]

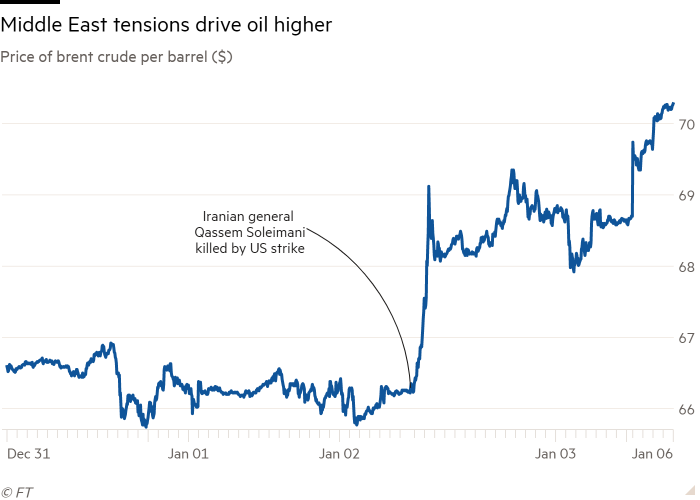

Oil price ranges surpassed $70 a barrel on Monday for the initial time in much more than 3 months as the US warned of greater threats to energy facilities in the Center East, immediately after the assassination of an Iranian general previous 7 days.

Brent crude, the global benchmark, was up 2.1 per cent at $70.07 in early European trading, acquiring risen as superior as $70.74 in Asian trade. Brent has climbed more than 5 for every cent considering that US air strikes killed Qassem Soleimani in Iraq on Friday.

The newest gains adopted a weekend of threats between Washington and Tehran, bringing the pair nearer to conflict and raising tensions through the Center East.

Crude past traded briefly above $70 a barrel in September after strikes — which the US blamed on Iran — temporarily knocked out half of Saudi Arabia’s oil creation.

Soleimani was the head of the Iranian Groundbreaking Guards’ abroad forces and controlled the regime’s in depth impact across Lebanon, Iraq, Syria and Yemen.

The US point out section warned on Sunday that there was an increased risk of attacks on oil services and other targets in Saudi Arabia, amid common anticipations Iran would retaliate for the killing of Soleimani.

Following the assassination, Iran mentioned it would no for a longer period abide by any of its commitments to the 2015 nuclear accord it signed with planet powers.

The price of West Texas Intermediate, the US marker, strengthened on Monday by 1.7 for every cent to $64.15.

Oil charges will “likely increase significantly even further if Iran retaliates, possibly by attacking Saudi oil services as it did in September, or trying to block the Strait of Hormuz, by means of which 20 per cent of international oil offer is transported”, mentioned Michael Pearce, senior US economist at exploration business Cash Economics.

Analysts at Goldman Sachs instructed the risk high quality currently baked into price ranges was currently also substantial and that “actual supply disruption” would now be required to retain rates at present ranges.

Still, with Center East tensions growing, traders have ongoing to shift out of riskier belongings and into haven belongings.

The price tag of gold for immediate delivery rose 1.3 per cent in early European buying and selling on Monday to $1,572 an ounce, the best amount because early 2013.

Japan’s Topix fairness index sank 1.4 per cent as the yen, also viewed as a haven asset, traded at a a few-month large towards the US greenback. The produce on US 10-12 months Treasuries was flat at 1.794, getting dipped in Asian trade.