Corporate bond market wavers ahead of US election

[ad_1]

Corporate bond markets are beginning to creak ahead of the US election as investors become more skittish, fearful that rising coronavirus cases and delays in Washington on further stimulus could hit the US economy.

Investors have sought to walk a tightrope in recent weeks, balancing America’s uncertain political direction and what it means for the response to the pandemic against supportive monetary policy, with the Federal Reserve continuing to signal its intent to stand behind credit markets.

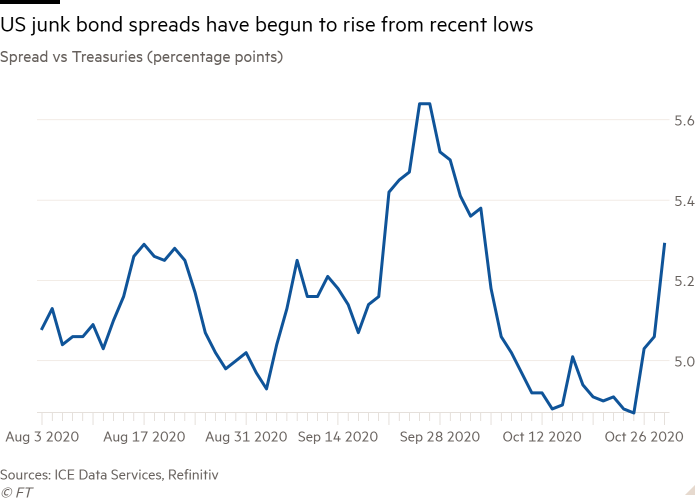

The premium in borrowing costs that investors demand on lowly rated corporate bonds over Treasuries — known as the spread — has recorded the largest three-day rise since the start of June, according to ICE Data Services based on Wednesday’s close.

The junk bond spread had been holding at its lowest level since February, highlighting how placid credit markets have been in recent weeks. Polls pointing to a Democratic victory in the upcoming elections bolstered hopes that Washington will pass a new stimulus to shore up the economy. At the same time, support from the Fed had helped offset concerns about how the worsening pandemic will affect corporate America.

However, in a sign of how markets have become more jittery this week, two junk bond sales have been pulled, according to people familiar with the transactions. One of the deals was a $325m bond being sold by franchise restaurant operator Sizzling Platter, a company that sits in one of the sectors worst affected by restrictions on socialising.

“We are not in the mode of nothing is wrong in the world,” said Ashish Shah, co-head of fixed income at Goldman Sachs. “Credit markets are reflecting the risks that exist but they are also reflecting the positives.”

Rapidly rising cases of coronavirus in many European countries and the worsening of the outbreak across America hit asset markets broadly this week. The S&P 500 stock index has fallen roughly 5 per cent, while Brent crude oil prices have dropped close to 10 per cent.

A deadlock between the Trump administration and Democrats in Congress on a new round of fiscal stimulus measures has also weighed on sentiment.

Dan Ivascyn, chief investment officer at asset manager Pimco, said credit investors, who have been “counting on a meaningful improvement in virus containment over the next few months”, need to be “very careful”.

He said that supportive fiscal and monetary policy could offer a temporary reprieve for the industries worst affected by the pandemic, like airlines and cruise operators, but “at a certain point it becomes a solvency issue”.

“The clock is ticking,” he said.

The warning comes alongside subtle signs that investors are guarding against a surprise election result.

The default risk implied by derivatives called credit default swaps, used by investors to protect against the corporate bond issuers reneging on their debts, has steadily risen over the past fortnight, according to data from Markit, implying greater hedging activity among portfolio managers.

Options on credit default swaps that expire shortly after the US election have also risen notably in price, suggesting that investors are particularly concerned about the risk of a sell-off in the corporate debt market next month, according to analysts at BNP Paribas.

“A lot of hedges have been put in place. The price you pay for options expiring immediately after the election is very expensive,” said Viktor Hjort, head of credit research at BNP.